Why You Should Learn Quickbooks (with a CPA’s help)

Disclosure: I am not an accountant. You should seek advice from a qualified accountant on all financial decisions for your business.

Whether you're an entrepreneur or you simply want to save money by doing your accounting yourself, there are so many benefits to learning Quickbooks (with the help of a CPA, of course).

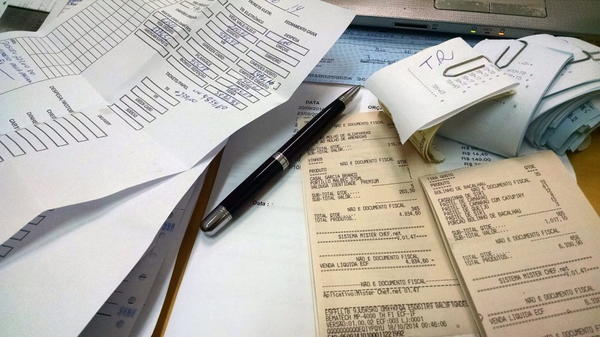

Being a creative, the last thing you probably want to do is get intimate with your bank statements and bury yourself in spreadsheets and stacks of receipts. We all know how important keeping on top of our finances and taxes is to the success of our business, so it might seem a natural next step to hire out your accounting to a professional if you don’t want to do it yourself.

Choosing a CPA

A Certified Public Accountant (CPA) can help guide you in making financial decisions for your business that can affect your taxes, what type of business entity will best fit your business, how you pay yourself, how to properly reimburse yourself for business expenses, and assess your risk for audit. Ask fellow business owners or use a site like DaveRamsey.com to find accountants that match your values and your business type.

I chose a CPA within an hour drive from me that was a small firm who likes hands-on interaction with clients. We have the option of meeting in their offices or doing meetings online via Go-to-Meeting or other online conferencing tools. Most CPAs will offer a free consultation to start so they can get a feel for what you need and you can see if you like working with them.

You can hire a firm to do all of your books but what most impressed me about the CPA firm I chose is that they encouraged me to keep charge of the day-to-day accounting for my business while they help with the heavy lifting, such as filing corporate taxes, reminding me when I need to file payroll taxes, or editing my Chart of Accounts. This option is much more affordable than paying the CPA’s hourly rate to keep my books and I am much more aware of my business’s financial health than if they were doing my books for me.

Getting Started

In the beginning, the going might be difficult. If you aren’t already using accounting software, you will need to invest some time in learning the software as well as purchase a software solution. Your CPA may be able to offer advice on how to get discounted software and what type of software package is right for you.

If your receipts are kept in a shoebox and you don’t reconcile your bank account, you will need to allow yourself a few hours a week to get all of your accounting in order. Your CPA can do this for you but it is much cheaper for you to do it on your own, as CPAs charge by the hour. Since they don’t know what your purchases were for, they will have to take more time to figure out what you spent and why than you would if you did your accounting on your own.

Doing Accounting Yourself

There are serious advantages to doing your accounting yourself, with guidance from a CPA, versus ignoring your accounting or hiring it out completely.

Entering your receipts into your accounting software on your own as well as reconciling your accounts yourself gives you a chance to re-examine your purchases and income for the month. For example, after doing my books myself I realized that I was spending what seemed to be a disproportionate amount of my business funds on food for meetings. You can then review the issue, make sure you have proper documentation for any necessary expenditures, and adjust your spending habits if you notice that the behavior needs to change.

After doing my books myself, I am much more conscientious about how I spend my business funds. For example, we learned that reconciling a Paypal account in Quickbooks is tricky so I minimize my Paypal purchases and withdraw the funds to my bank account (from which I make purchases) to make my reconciliations easier.

I enter receipts weekly and reconcile once a month, giving me a chance to review what I’ve spent and earned, and to document it accurately. This is much easier and less time-consuming than trying to remember what that $200 spent at the fabric shop in March of last year was for when it comes time to do my taxes in April of the following year.

What Your CPA Can Do for You

A CPA can oversee your accounting and you can do monthly reviews with them as well.

For the first months, I had QuickBooks, my CPA and I would meet online and review the entries, figure out any reconciliation problems, and identify areas I needed to be aware of in case of audit. For example, my CPA brought it to my attention that my mileage claims seemed high compared to other businesses in my industry. We figured out a way for me to better document my driving activities in case of audit. And I realized I could plan my trips differently for less cost so it informed a change in how I do travel in my business, saving me both time and money.

Regular meetings with the CPA can help you learn about proper accounting, such as how to properly reimburse yourself for expenses paid from a personal account. A CPA can also help you decide when it is time to put yourself on proper payroll and what type of business entity (Corporation, S or C Corporation, LLC, Sole Proprietor) is best for your business.

In addition, the accountant can teach you how to run reports in Quickbooks, such as Profit & Loss Statements, that you may need to conduct business activities, such as working with your bank to get a loan, applying for a grant, or personal finance needs like documenting your income so you can buy a car. Being involved with your books equips you with the knowledge about your business that will help you best make decisions and grow your business.

What to ask a CPA firm before hiring them

- Are they familiar with handmade businesses like yours?

- Do they know how etsy works? (or another online platform you are using to sell your work)

- Are they familiar with working with Paypal or any online shopping carts that you use for your business?

- How much do they charge per hour? And is there an associate in the firm you can work with at a lower rate after your books are set up?

- How and when do they bill you?

- Are they willing to train you on accounting software or to help you as you learn the software and about accounting?

The benefits of doing your own books are saving money on data entry costs and having a much more in-depth knowledge of your business’s finances and where you spend your money. Seek guidance from a CPA or accounting firm in making larger financial decisions about your accounting or business entity type and for complex tasks, such as filing taxes. Learning how to use accounting software, such as Quickbooks, will help you be able to easily run reports, like Profit & Loss Statements, needed for loan applications and other business transactions. And finally, doing your own books will help you make better decisions about your business income and expenditures.

Your Recently Viewed Projects

flowergirl

Nov 23, 2018

I haven't thought of using QuickBooks or any other digital accounting software before. This article has all the best reasons why you should consider using the service. It'll make running your business alot more organized and efficient.

Eugenia

Mar 09, 2018

I've used quickbooks before to help out my dad and one big tip is to make sure you enter in your checks as soon as possible. That way you aren't wondering 3 months later what you signed a check for when you're entering it into the program!

Report Inappropriate Comment

Are you sure you would like to report this comment? It will be flagged for our moderators to take action.

Thank you for taking the time to improve the content on our site.