Budgeting Rules of Thumb: Budgeting for Beginners

From car buying to college savings, learn how to best budget for large expenses!

There are many critical questions about your financial future that you’ve probably asked yourself. Many people don’t know the fiscally responsible method of buying a car, let alone how much they should save for retirement. These budgeting rules of thumb give you general guidelines to follow for large purchases and savings. Don’t feel lost at the prospect of your future finances; learn how you can be economically secure with these budget rules for large expenses.

We’ve outlined guidelines that will give you a starting point for assessing your own budget. These rules of thumb are flexible, so adjust them to fit your current finances and needs. If you’re puzzled by anything from college savings to home ownership, read on to find out an estimate of when you will be fiscally secure.

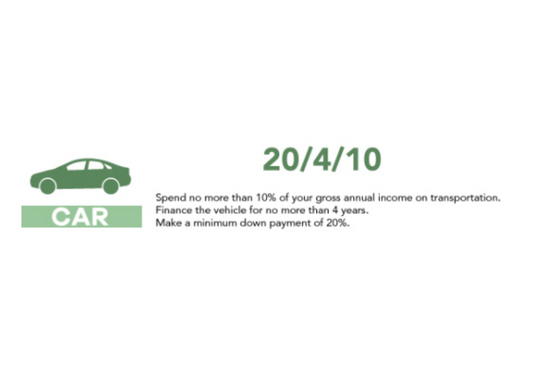

The 20/4/10 Rule for Car Buying

When buying a new-to-you vehicle, the price may be a bit overwhelming. The sticker price is never what you end up paying when fees are added, and a car that you thought was in your budget quickly can be way too pricey. This rule of thumb gives you a way to determine if a car is in your budget, so you can make your car payments every month.

You should always make a minimum down payment of 20% in cash. The higher payment you can make, the less interest you will accrue over time.

You should never finance a vehicle for more than four years. Cars, especially used cars, may not last you many years without significant upkeep. The last thing you want is to be making payments on a car that you can no longer drive.

You should only be spending 10% of your annual income on transportation. This includes everything from car payments to insurance and gas. If your car payment alone is over 10% of your income, there’s a problem.

The 20% Rule for Home Buying

Like car buying, home ownership is a white whale of its own. You have to balance facets like location and size with the all-important price tag. With such a variance in price, it can be hard knowing where to start. This guideline is here to help!

Similar to purchasing a car, your down payment on a home should be 20%. This will drastically decrease your overall mortgage and ensure you move into a home that will fit your price range long-term.

You should also look for homes that cost around four times your annual salary. The standard mortgage loan is for 30 years, so this number gives you flexibility while still being reasonable.

The 10% Rule for Retirement

This rule is easy, and you might already adhere to it. The best way to save money for retirement is to allocate 10% of each paycheck to your 401k or retirement savings account. This will ensure that your account is steadily growing over time.

The 10X Rule for Retirement

When you near retirement age, you may wonder if you have enough saved to retire. While every retiree has a different lifestyle, you should strive to have a minimum of 10 times your annual income saved. If you plan to travel frequently or adopt a lush lifestyle, you may want to save closer to 20 times your annual income to accommodate.

The 2K Rule for College Savings

Do you wonder if you have enough money stored away for your child’s savings? This rule will help show you approximately how much you should have saved based on your child’s age.

Multiply your child’s current age by 2,000. The resulting number is around how much you should have in a college savings account to cover approximately 50% of tuition at a four-year public university. This will give your child a helping hand so they don’t have to foot the entire bill themselves.

Budgeting Rules Infographic

Have you used any other budget rules of thumb? Let us know about your experience in the comments!